Estate Taxes and Philanthropy

Since our nation’s founding, voluntary action and charitable giving have been an important part of how Americans pursue the common good. We give generously because we want to make the world better, solve a problem, or help someone in need.

But the truth is, study after study shows that tax policy matters too. It affects when we give and how much we give.

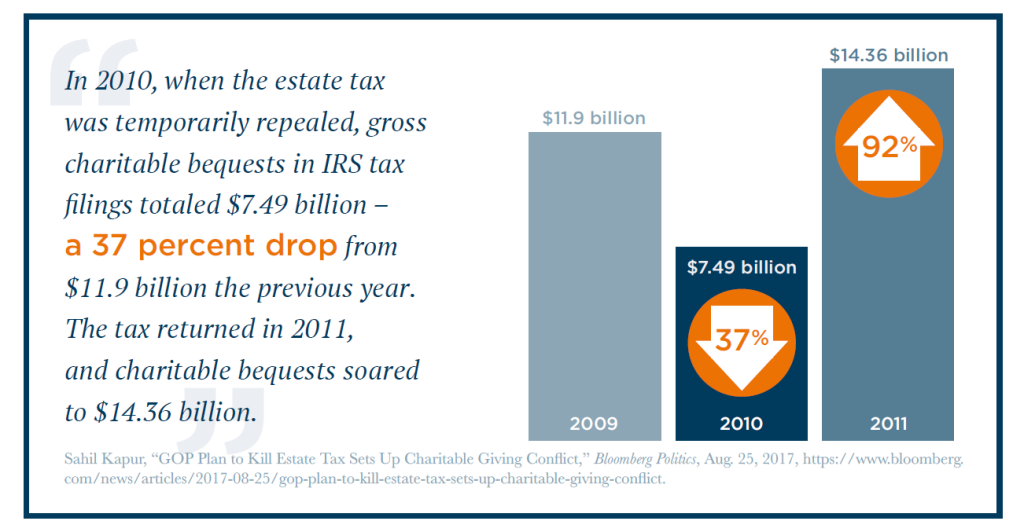

The estate tax is one of the most important motivators for charitable giving for those at the very top of the income distribution. Rather than see a sizable portion of their estates subject to taxation, wealthy families give while living to reduce the size of their estates; and they also give in the form of bequests upon their death. These gifts to schools, hospitals, human services, the arts, and other vital needs contribute to the fabric of society in every state, and the public relies on such gifts at a time when public spending at all levels of government is increasingly squeezed.

Americans are charitable people who will surely give in absence of a charitable deduction or an estate tax, but any well-off American (or their tax advisor) will tell you that tax policy plays a role in determining the size and timing of charitable gifts.

Americans are charitable people who will surely give in absence of a charitable deduction or an estate tax, but any well-off American (or their tax advisor) will tell you that tax policy plays a role in determining the size and timing of charitable gifts.

Most Americans will never pay the estate tax. The permanent compromise reached in 2013 raised the threshold so that only estates over $5.5 million per individual and $11 million per couple are subject to the tax. As a result, only about one American in 500 will ever be subject to the tax – but those households are responsible for a significant percentage of total charitable giving. Their gifts support the hospitals, universities, and other nonprofits that improve the quality of life in every state.

Transformative Impact

If the estate tax is repealed, it will be devastating to the nonprofit sector – not for the $100 or $1,000 gifts upon which all charities rely, but for the $10 million or $100 million gifts that can be truly transformative.

The existence of the estate tax is a trigger that encourages the wealthy to act on their charitable impulses. Without an estate tax, many of the largest and most transformative gifts may never be made.

The Chronicle of Philanthropy has compiled detailed data on publicly reported charitable gifts of more than $1 million in each state. Note that this data only approximates the total amount of large gifts; many millions of dollars of charitable gifts may be made anonymously, but still timed to avoid estate taxes or reduce the size of one’s estate below the exemption.

In short, if the estate tax is fully repealed, many of these gifts will disappear, and the nonprofit sector in your state will bear the consequences. We can’t let that happen.

Members of Congress should ask themselves the following: Which of the large gifts in their states would they be willing to do without?

Download this fact sheet as a PDF .

.

View state fact sheets

All data and examples courtesy of The Chronicle of Philanthropy.

Media coverage of NCRP’s estate tax campaign

Repealing the estate tax could shut the door on charitable giving, Bangor Daily News

House Signs Off On Tax Bill That Hurts Charities, The NonProfit Times

Charities Are Divided Over Efforts to Kill the Estate Tax, The Chronicle of Philanthropy

If estate tax is repealed, charitable giving will take a major hit, The Denver Post

Keep the Estate Tax, The New York Times

Estate Tax Repeal Would Be Devastating for Philanthropy in America, HuffPost

Will rich bequeath to charities if estate tax ends?, The Baltimore Sun

Estate Tax: Few family farmers are ‘burdened’, Argus Leader

Repealing federal estate tax could cause declines in large donations, The Columbus Dispatch

Additional information about the estate tax

Gary Cohn says the estate tax repeal isn’t just about the wealthy. Here’s the truth., The Washington Post

Opposition to Eliminating the Estate Tax, Philanthropy New York